Best RBL Bank Credit Cards in 2025

- 25 Nov 25

- 10 mins

Best RBL Bank Credit Cards in 2025

- List of Active RBL Bank Credit Card in 2025

- What are the Benefits of RBL Bank Credit Cards?

- What are the Applicable Terms and Conditions on RBL Bank Credit Cards?

- What is the Eligibility Criteria of RBL Bank Credit Card?

- Which Documents are Required to Get an RBL Bank Credit Card?

- What is the Procedure of Activation for RBL Bank Credit Cards?

- Which Payment Methods are Accepted for RBL Bank Credit Card Bill Payment?

- How to Determine the Best RBL Bank Credit Card?

- How to Maximise the Credit Limit on RBL Bank Credit Cards

- Conclusion

Key Takeaways:

- An applicant for an RBL Bank credit card must be between 21 and 70 years old.

- The minimum income requirement to apply for an RBL credit card is ₹25,000.

- You can get vouchers worth ₹7,000 in a year with the RBL Bank Cookies credit card.

- A minimum credit score of 750 is required to qualify for an RBL Bank credit card.

- You can earn 500 reward milestone benefits for all quarterly spends of ₹75,000.

RBL Bank credit card offers a vast range of benefits which are tailored to different lifestyles. Whether you love shopping, travelling, or earning rewards, there is a suitable credit card for you.

From cashback and discounts to travel perks and easy EMI options, RBL cards provide flexibility and value. In this article, we will discuss everything you need to know before choosing the perfect RBL credit card.

List of Active RBL Bank Credit Card in 2025

IRCTC RBL Bank Credit Card

5 reward points for every ₹200 spent on IRCTC train ticket bookings

Indian Oil RBL Bank XTRA Credit Card

6% value back at Indian Oil fuel pumps

Indian Oil RBL Bank Credit Card

250 litres of free petrol at fuel points yearly

RBL Bank Icon Credit Card

Buy 1 get 1 movie tickets free at BookMyShow per month.

RBL Bank World Safari Credit Card

0% markup fee on types of foreign transactions

RBL Bank Platinum Maxima Plus Credit Card

10,000 reward points as a welcome bonus

RBL Bank Platinum Delight Credit Card

4,000 reward points as a welcome benefit

RBL Shoprite Credit Card

10% discount on movie tickets on BookMyShow bookings

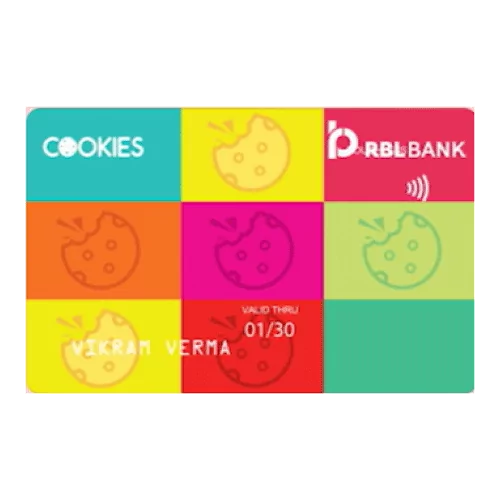

RBL Cookies Credit Card

Vouchers worth ₹7,000 in a year

RBL Bank Play Credit Card

₹100 worth of beverages and food on movie ticket bookings

RBL Bank Patanjali Vishant Credit Card

10% cashback on spends at Patanjali stores

RBL Bank Patanjali Swarn Credit Card

1 reward point for every ₹100 spent at offline or online stores

What are the Benefits of RBL Bank Credit Cards?

Here is a list of RBL Bank credit card benefits:

- Get up to 1% (up to ₹5,000) surcharge waiver on all train ticket bookings at IRCTC.

- You can avail of 8 complimentary accesses to select IRCTC executive lounges every year (this is applicable to primary cardholders).

- Every single reward point is equivalent to ₹1.

- Get complimentary protection coverage in the event of train cancellation (up to ₹5000).

- Get a 500 reward milestone benefit on all kinds of quarterly spends of ₹75,000.

- Benefit from 2 reward points on every ₹200 spent on hotel/flight/tourism ticket booking through the portal of IRCTC.

What are the Applicable Terms and Conditions on RBL Bank Credit Cards?

- Revocation or Termination

The bank has the right to terminate the credit card facility at any time. They have sole discretion to restrict usage by stating the reason with due notice to the cardholder.

- When a credit card is cancelled, the cardholder needs to diagonally cut the card in half and return both halves to the bank promptly.

- For instance, if the cardholder is changing their professional address, the bank, at its sole discretion, can discontinue the credit card for that cardholder.

- If a cardholder does not activate their credit card within 30 days of issuing the card, the benefits associated with the credit card will be revoked.

- If the credit remains unused for a continuous period of 1 year, the bank will permanently discontinue the card.

- Misuse/Theft or Loss

The cardmember has to notify RBL Bank on an immediate basis by calling the RBL Bank helpline number. In case the credit is lost, misused, stolen, or broken, then revert to the bank promptly.

Additionally, it is necessary for the cardholder to file a FIR (First Information Report) at the local police station about the theft of a credit card.

- Billing Statements

The billing statement is sent to the registered email address of the cardholder or their mailing address. The monthly statement consists of all the details regarding the payments, which are credited and debited transactions to the account of the cardholder.

In the event that there is any change made to the communication address of the cardholder, the cardholder needs to contact RBL Bank promptly. This will ensure that the statements and records are sent to the right person.

Note: If you want the full list of terms and conditions associated with the RBL Bank credit card, visit their official site.

What is the Eligibility Criteria of RBL Bank Credit Card?

- Age: An applicant for the RBL Bank credit card needs to be between 21 and 70 years of age.

- Income: The minimum income requirement is ₹25,000. This applies to both self-employed individuals and self-employed professionals. People need to showcase proof of steady income.

- Credit Score: Having a minimum credit score of 750 is a must. Having a good credit history showcases responsible management of credit.

Which Documents are Required to Get an RBL Bank Credit Card?

- Proof of Identity

| Voter’s ID Card |

| PAN Card |

| Aadhaar Card |

| Driving Licence |

| Passport |

- Proof of Income

| Form 16 |

| Bank statement for the previous 3 months |

| Audited financials of the past 2 years (only for self-employed people) |

| Salary slips for the past 3 months |

- Proof of Address

| Passport |

| Aadhaar Card |

| Utility bills (less than three months old) |

What is the Procedure of Activation for RBL Bank Credit Cards?

There are three ways to activate your RBL Bank credit card:

- Through Netbanking

- First and foremost, you have to do an RBL Bank credit card login using your credentials.

- Next, fill in the required details such as credit card number, expiry date, and your date of birth.

- Click on the option labelled as 'send OTP'. Enter that.

- Now you can generate a new PIN of your choice to activate your RBL credit card.

- Through Mobile Banking

- Install the RBL MyCard app on your device.

- Then log in to the app by using your credentials.

- Next, navigate to the option labelled 'account services'. There, you will further get an option called 'change PIN'.

- Enter a PIN of your choice, and you will be done.

- By Visiting the Branch

If you are not a fan of online methods, you can visit the RBL bank that is located nearest to you. You can visit the customer care services department to query about credit card activation. Their staff will help you with it.

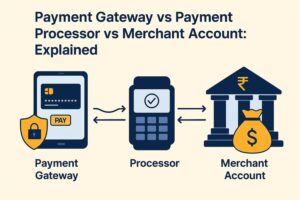

Which Payment Methods are Accepted for RBL Bank Credit Card Bill Payment?

The accepted payment methods made towards the credit card bill payment of RBL Bank are:

- Online Card Payment

This can be done by visiting the official site of RBL Bank, then clicking the option labelled 'payments > credit card payments'.

- Through the RBL Banking Mobile App

You can also initiate payment through the RBL MyCard app. If you want to download the app, just send an sms 'MyCard' to 5607011.

- Through NEFT

It is another easy way to pay your credit card bill. Make sure to add your RBL Bank credit card as a payee in your other bank account to initiate a transfer.

- Cheque

Alternatively, you can drop in your cheque at the nearest RBL Bank branch to complete your credit card bill payment.

Want to simplify the process of credit bill payments even further? Then download the Pice app today!

How to Determine the Best RBL Bank Credit Card?

- Annual fees

Most of the credit cards have associated annual fees. However, they can be waived if a cardholder meets the set expenditure limits.

- Finance charges

This is another thing to keep in mind when selecting the best RBL Bank credit card. Banks charge interest if you use revolving credit. This credit refers to you carrying an outstanding balance beyond the due payment date.

- Late Payment Fee

Settling the outstanding payment balance after the due date causes the bank to charge a late payment fee. Make timely payments to avoid that.

- Cash Withdrawal Fee

If you make cash withdrawals or take out money from an ATM, your credit card attracts certain charges and interest. It is also known as a cash advance fee.

- Reward Structure and Benefits

Different RBL credit cards offer varying reward rates on categories like dining, fuel, travel, or online shopping. Choose a card that matches your spending habits so you can earn maximum value from your everyday transactions.

- Partner Offers and Discounts

Check whether the card offers exclusive benefits, such as complimentary lounge access, cashback on partner brands, special festival discounts, or flexible reward redemption. These perks can significantly enhance the card’s overall value.

- Customer Support and Service Quality

Consider the responsiveness and reliability of the customer service. A card backed by efficient support makes it easier to resolve disputes, report fraudulent transactions, and get quick assistance whenever needed.

How to Maximise the Credit Limit on RBL Bank Credit Cards

Your credit card limit indicates how much you can spend in a billing cycle without incurring penalties. You can increase this limit by following a few effective practices:

- Make Timely Payments

Pay your credit card bills on or before the due date. Making consistent on-time payments reflects responsible usage. It encourages the bank to increase your credit limit.

Whereas missing payments can harm your credit score and lower your chances of getting a higher limit.

- Use Your Credit Card Regularly

Use your credit card frequently for everyday expenses and pay off the balance in full. Regular and responsible usage signals active financial behaviour. It will help you build a positive spending pattern and a strong credit score.

- Request a Card Upgrade

Many banks allow cardholders to upgrade to a higher variant, which usually comes with a higher limit. Check with RBL Bank to see if you qualify for an upgrade based on your credit history and usage.

- Keep Your Income Information Updated

Banks determine your repayment capacity based on your income. If your salary increases, inform the bank and submit the necessary documents. It can strengthen your case for a credit limit enhancement.

- Avoid Multiple Credit Applications

Limit the number of new credit card or loan applications you make within a short span. Conducting frequent inquiries can indicate financial instability and negatively affect your credit profile, reducing the chances of future limit approvals.

Conclusion

RBL credit cards combine convenience, rewards, and financial flexibility. It makes them a smart choice for everyday spending and big purchases alike. By getting to know about the features, fees, and benefits, you can maximise your card’s potential and enjoy greater savings.

Ready to make the most of your RBL credit card? Use the Pice app to pay bills on time and earn more benefits.

By

By